salt lake county sales tax rate

The Utah state sales tax rate is currently 485. The December 2020.

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

This is the total of state county and city sales tax rates.

. The County sales tax rate. 04499 lower than the maximum sales tax in UT. 4 rows The current total local sales tax rate in Salt Lake City UT is 7750.

Bills and collects all real property taxes administers statutory tax relief programs refunds tax overpayments distributes all taxes collected to local tax entities. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax. The minimum combined 2022 sales tax rate for South Salt Lake Utah is.

This is the total of state county and city sales tax rates. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information. The minimum combined 2022 sales tax rate for Salt Lake County Utah is 725.

HH County Airport Highway Public Transit AT Transportation Infrastructure SM Supplemental State Sales Use Beaver County 01-000 470 100 025 595 Beaver City. Refer to Rules and. A refundable 500 deposit is required by May 23 rd to bid on properties.

The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for North Salt Lake Utah is 725.

This page lists the various sales use tax rates effective throughout Utah. While many other states allow counties and other localities. The Utah sales tax rate is currently 485.

The current total local sales tax rate in North Salt Lake UT is 7250. Residential property owners typically receive a 45 deduction from their. The minimum combined 2022 sales tax rate for Salt Lake City Utah is.

The Utah sales tax rate is currently. The December 2020 total local sales tax rate was also 7250. Download all Utah sales tax rates by zip code.

725 Salt Lake City UT. The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that spans from 725 to 875. The certified tax rate is the base rate that an entity can levy without raising taxes.

This includes the rates on the state county city and special levels. The tax sale will be held May 26 2022. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes.

Tax sale will be online through Public Surplus. The value and property type of your home or business property is determined by the Salt Lake County Assessor. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

3 rows The current total local sales tax rate in Salt Lake County UT is 7250. The Utah sales tax rate is currently. This is the total of state and county sales tax rates.

The County sales tax. Salt Lake City UT. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City.

The various taxes and fees assessed by.

Top Counties With Lowest Effective Property Tax Rates In 2021 Attom

Finance Committee Of The Cook County Board Approves A Partial Sales Tax Rollback The Civic Federation

Tc 62s Fill Out Sign Online Dochub

Utah Sales Tax Small Business Guide Truic

Salt Lake City Utah Tourism Visit Salt Lake

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

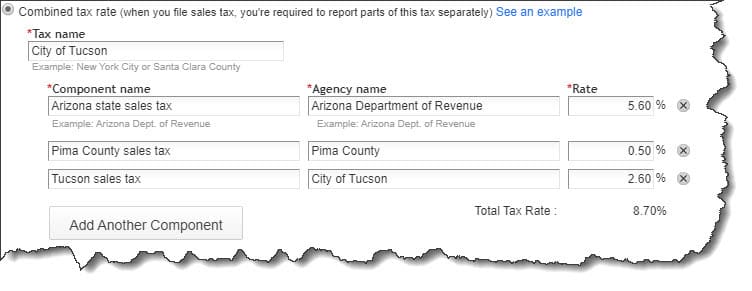

5 Things You Need To Know About Sales Tax In Quickbooks Online

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

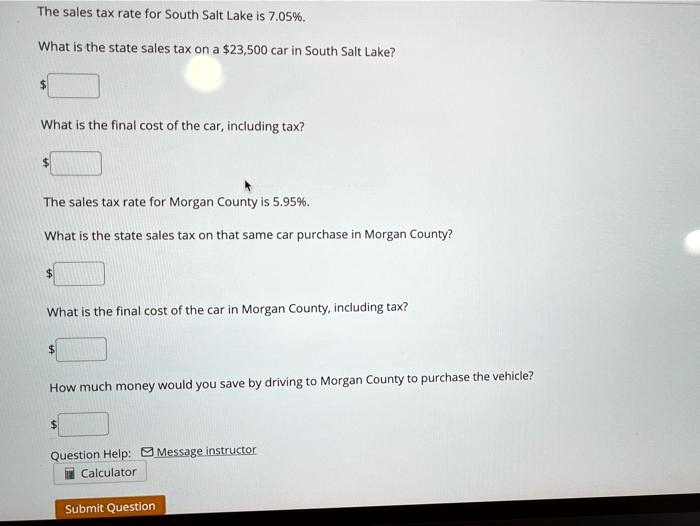

Solved The Sales Tax Rate For South Salt Lake Is 7 05 What Is The State Sales Tax On 523 500 Car In South Salt Lake What Is The Final Cost Of The Car

Los Angeles Sales Tax Increase July 1st Restaurant Consulting Firm

Prop 1 Could Widen Disparity In Utah Sales Taxes

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

The Two States Of Utah A Story Of Boom And Bust Deseret News

State Sales Tax Rates And Combined Average City And County Rates Download Table